this post was submitted on 30 Mar 2024

120 points (96.9% liked)

Memes

7821 readers

593 users here now

Post memes here.

A meme is an idea, behavior, or style that spreads by means of imitation from person to person within a culture and often carries symbolic meaning representing a particular phenomenon or theme.

An Internet meme or meme, is a cultural item that is spread via the Internet, often through social media platforms. The name is by the concept of memes proposed by Richard Dawkins in 1972. Internet memes can take various forms, such as images, videos, GIFs, and various other viral sensations.

- Wait at least 2 months before reposting

- No explicitly political content (about political figures, political events, elections and so on), [email protected] can be better place for that

- Use NSFW marking accordingly

Laittakaa meemejä tänne.

- Odota ainakin 2 kuukautta ennen meemin postaamista uudelleen

- Ei selkeän poliittista sisältöä (poliitikoista, poliittisista tapahtumista, vaaleista jne) parempi paikka esim. [email protected]

- Merkitse K18-sisältö tarpeen mukaan

founded 2 years ago

MODERATORS

you are viewing a single comment's thread

view the rest of the comments

view the rest of the comments

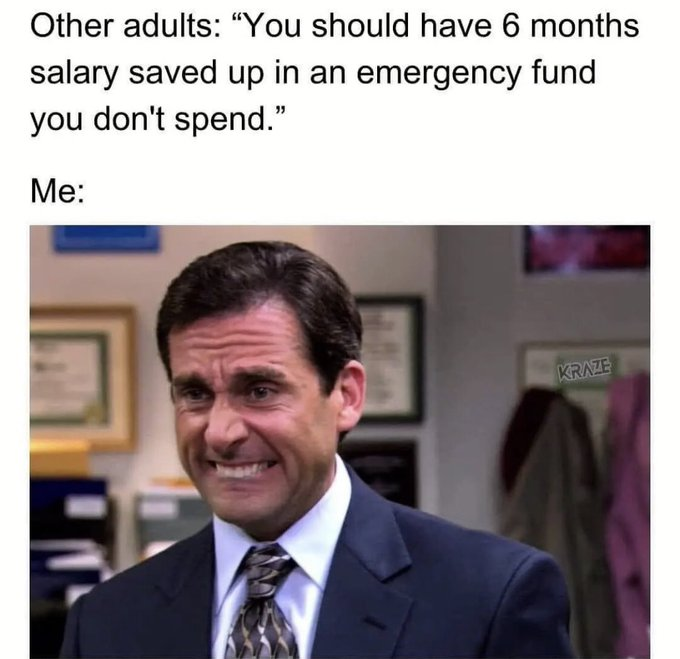

I honestly think the "6 months of salary in an emergency fund"-advice is a bit overblown and certainly not universally applicable.

An emergency fund must per definition be very liquid in order to fulfill its purpose, hence you can only really place the money in a simple savings account with a not-so-spectacular interest rate. This means that the opportunity cost of having 6 months of salary in an emergency fund is the delta of expected return on investment in a higher-yield method of savings, such as placing the money in index funds. This can be quite significant, in particular since saving up 6 months of salary is not an easy task for the average person.

If you had the money placed in investments, the money would be less liquid, and there's the chance that you may have to liquidate it during a downturn, which would of course suck a little. Consider carefully under which scenarios you would have to liquidate, though:

Now, there's an argument to be made that these insurance policies might be a bit slow to pay out, and that I might need to be a bit more liquid to cover the expenses temporarily. I have a solution for that too - credit cards. With credit cards I can make a short-term loan that should bridge over most issues until I can either get money from any of my insurance policies, or worst case have time to liquidate some of my higher-yield investments.

So yeah, that's my plan. It does not involve 6 months of salary being invested in a low-yield savings account, because that'd lose me a lot of money. I dislike the fact that the 6 months emergency fund is basically parroted as religious gospel, and it feels like people who repeat it have not thought about the issue thoroughly.

Stocks and mutual funds are liquid enough to act as an emergency fund; you don't need to rely on a savings account only to hold your emergency fund.

Would certainly suck if those six months worth of emergency fund had temporarily gone down to four months because of a downturn in the stock market though.

Accidentally there might also be some correlation with stock markets going down, and an emergency happening. Eg large company laying staff off.

That said you can do the math and see how much that money would return on average on etfs compared to a bank account, and decide if that's worth the risk to you.

Experts say no, I agree with them but I see your point, and it's definitely worth to challenge these suggestions.

The only way you can have your emergency fund invested is if you have a very good credit card which can cover all your expenses for a month or two. You can then reduce your emergency fund to one month's worth so you can have cash if needed.

I had an 18 month 0% card last year. I floated a bunch of expenses on it and paid it off a few days before interest kicked in. I also earned rewards points from the card, so double win I guess.