I have never deducted my mortgage on my taxes. Only a percentage of the property tax paid. If there is a way to deduct an entire mortgage i would love to know

Memes

Rules:

- Be civil and nice.

- Try not to excessively repost, as a rule of thumb, wait at least 2 months to do it if you have to.

Quiet, we're trying to get mad at people we've never met over problems we made up over here.

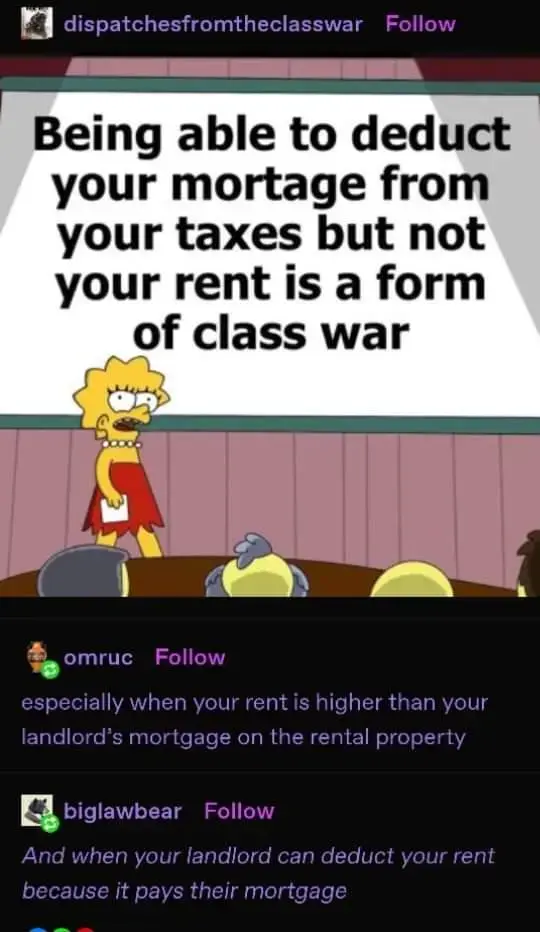

You can't deduct your mortgage from your taxes, only the interest. And only on mortgages related to your first or second home. From irs.gov

This part explains what you can deduct as home mortgage interest. It includes discussions on points and how to report deductible interest on your tax return.

Generally, home mortgage interest is any interest you pay on a loan secured by your home (main home or a second home). The loan may be a mortgage to buy your home, or a second mortgage.

Another important thing to note is that you only benefit from this if you have so many itemized deductions that you can do better than the standard deduction. The mortgage interest alone isn't going to do that in a vast majority of cases. Since legislation in 2017, a lot of the tax advantage of owning a home was reduced.

The OP is wrong on every conceivable level.

Yeah. To break down why this meme is bad information, in simple terms:

- You can't deduct "your mortgage". You can only deduct interest on a loan.

- You can't take this deduction on a rental property. You have to live in the home part of the year to take this.

- Since the tax changes in 2017, most homeowners don't deduct mortgage interest anymore, because it's better to take the standard deduction offered to anyone.

Don't share or believe bad information.

Oops, sorry

Look look look as a home owner with a mortgage, I think you're looking at this all wrong.

You should be furious and demanding correction French style.

It's super wrong and political action is desperately needed

In the US you can deduct the mortgage interest, which is even more of a benefit for the wealthy than the mortgage as a whole would be since the deduction decreases the longer someone stays in a home.

Social security being a flat percentage with a cap is also a form of class war.

Investment income being taxed less than employment income is another form of class warfare.

Why the hell do you pay more in taxes than Elon Musk?

Are you talking about capital gains tax?

First, let's be clear, the reason the rich pay little tax doesn't have much to do with the capital gains tax rate being lower.

Now the reason for the lower rate (at least ostensibly) is that while income is earned at a point in time, capital gains happens over large amounts of time. Therefore often a big part of the gain is inflation. Let's imagine you bought a house for $100k and 20 years later you sell the house for $140k. Over that time inflation has been a steady 2%.

Due to inflation $148k is now worth what $100k was worth 20 years ago. But when you sell you have to pay tax on the $40k profit even though you actually made a loss?

Lower capital gains rates are meant to adjust for this. Basically saying we understand part of the gain is inflation, so let's call it half inflation and half profit and we'll account for this by setting the capital gains rate at half the income tax rate.

Remember companies (that you might have shares in) or yourself as a land lord are (ostensibly) paying tax on profits as you go. Capital gains tax is in addition to this.

This comment is already long enough so I'll leave the conversation on whether this stuff is true in practice as an excercise for the reader, but it at least starts from a sensible place.

At least where I live (not the US), if you're day trading stocks or flipping houses you'll pay income tax not capital gains tax (ostensibly 😆).